Soaring Food Prices

by Paul Krugman, New York Times, February 5, 2011

What’s behind the surge in food prices? The usual suspects have made the usual claims — it’s all about the Fed, or it’s all about speculators. But I’ve been looking at the USDA World supply and demand estimates, and what stands out from the data is mainly that we’ve had a huge global harvest failure.

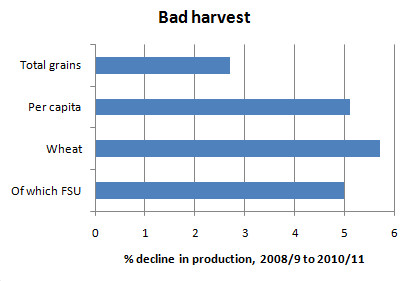

Here are some percentage changes in world grain production between 2008/2009 and 2010/2011, according to the USDA estimates:

Overall grain production is down — and it’s down substantially more when you take account of a growing world population. Wheat production (this time not per capita) is way down.

You might ask why a production shortfall of 5% leads to a doubling of prices. Part of the answer is that some kinds of demand are growing faster than population — in particular, China is becoming a growing importer of feedto meet the demand for meat. But the main point is that the demand for grain is highly price-inelastic: it takes big price rises to induce people to consume less, yet collectively that’s what they must do given the shortfall in production.

Why is production down? Most of the decline in world wheat production, and about half of the total decline in grain production, has taken place in the former Soviet Union — mainly Russia, Ukraine, and Kazakhstan. And we know what that’s about: an incredible, unprecedented heat wave.

Obligatory disclaimer: no one event can be definitively assigned to climate change, just as you can’t necessarily claim that any one of the fender-benders taking place right now in central New Jersey was caused by the sheet of black ice currently coating our roads. But it sure looks like climate change is a major culprit. And it’s not just the FSU: extreme weather elsewhere, which again is the sort of thing you should expect from climate change, has played a role in bad harvest around the world.

Back to the economics: if you want to know why we’re having a spike in food prices, the data suggest that the key cause is terrible weather leading to bad harvests, especially in the former Soviet Union.

Update: The USDA has estimates of price elasticities. For the United States, they put the price elasticity of demand for breads and cereals at 0.04 — that is, it would take a 25% rise in price to induce a 1% fall in consumption.

No comments:

Post a Comment