by Anna Hirtenstein, Bloomberg, May 30, 2018

“We are really observing a tipping point among the institutional investors on climate change,” said Frederic Samama, co-head of institutional clients at the Paris-based firm. “Until recently, that question was not on their radar screen. It’s changing, and it’s changing super fast.”

Risks from global warming range from damage to physical assets from extreme weather to falling prices on fossil fuel-related assets, as the world moves away from burning coal and oil. Bank of England governor Mark Carney has repeatedly warned that these risks are not priced in adequately and that investors may have exposure to a “climate Minsky moment” if they don’t take action.

Amundi’s remarks hold weight because it has 1.4 trillion euros ($1.6 trillion) under management, making it the largest asset manager in Europe. It runs the world’s largest green bond fund with the International Finance Corp. and is planning to deploy $2 billion into emerging markets. Mainstream investors are beginning to recognize both the threats and opportunities coming from climate-related issues, Samama said.

“If we have this major shift required in terms of how we manage the planet, for sure it will impact the asset prices,” he said. “Can we evaluate the automakers without taking into account the new bans of diesel cars? Can we evaluate the fossil fuel industry without taking into account the risks of regulation related to the drop of the price of renewable energy?”

The Paris climate deal reached by representatives from nearly 200 countries in 2015 sent a signal to the global economy that decarbonization was on the agenda. As just about every industry comes under pressure to become greener, the rules will change for the asset owners as well. France was the first country to make it mandatory for investors to disclose the carbon footprint of their portfolios, mandating it in a law the same year.

Another reason that institutional investors’ views are evolving is the availability of green financial instruments, according to Amundi. The asset manager developed low-carbon equity indexes, removing the polluting companies from commonly-used ones such as the S&P 500 and MSCI indexes. Investors from the California State Teachers’ Retirement System to Japan’s Government Pension Investment Fund are shifting their portfolios to these indexes, according to Samama.

“It means that if nothing happens, you have the market returns and that if the opposite, if polluting companies are getting penalized, they will bring the index down and if you have excluded them, you will outperform,” he said.

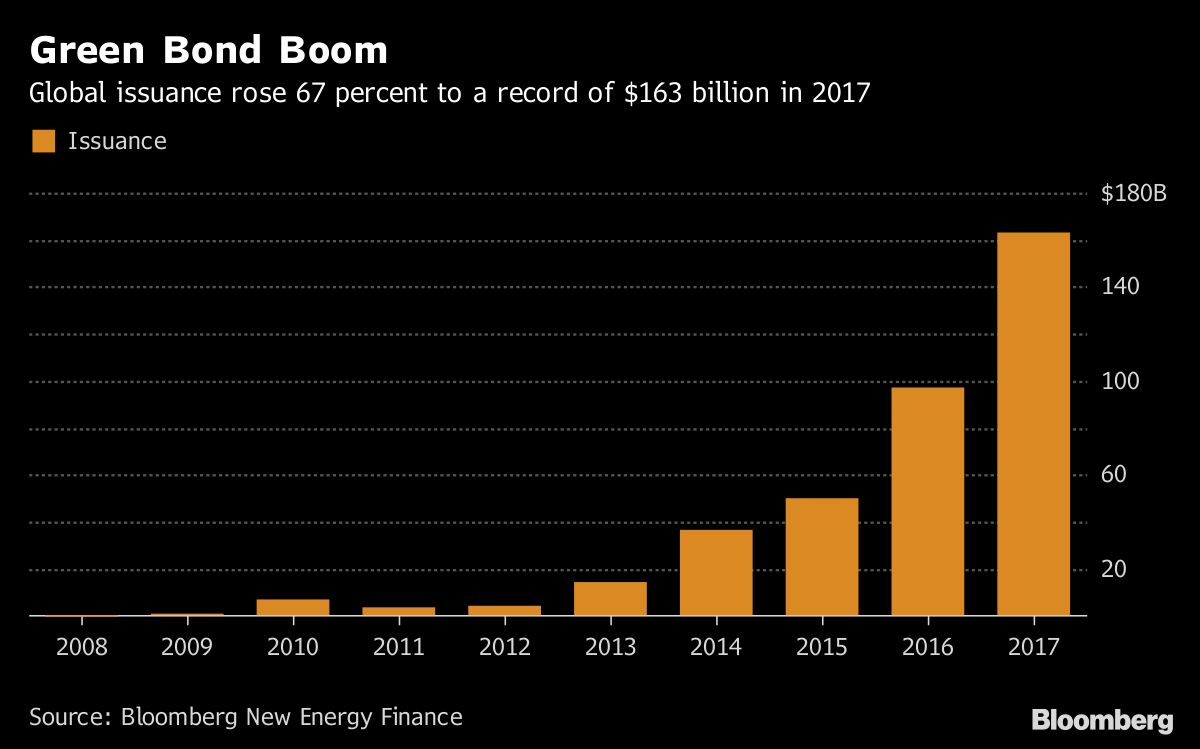

Green bonds are another avenue for redirecting institutional capital into environmental projects. The industry has soared from non-existence just over a decade ago to global issuance of $163 billion last year.

©2018 Bloomberg L.P.

No comments:

Post a Comment